(I) Insurance: Homeowners insurance and, if required, private mortgage insurance premiums (PMI) on a conventional loan.

(T) Taxes: Property taxes required by your city and county government. If the same $320,000 loan above has a 4% rate, then you’ll pay $12,800 for the first year in interest repayment (I) Interest: The amount of interest you’ll pay to borrow the principal. If you buy a home for $400,000 with 20% down, then your principal loan balance is $320,000 (P) Principal: The amount you owe without any interest added. Your mortgage payment consists of four costs, which loan officers refer to as ‘PITI.’ These four parts are principal, interest, taxes, and insurance. Here are tips to get your best mortgage rate Shop for a lower rate: Rate shopping doesn’t have to take long, and it’s well worth the savings. However, you will pay more in total interest over the life of the loan Longer loan term: A longer loan term means lower monthly payments. Avoid private mortgage insurance: When you put at least 20% down on a conventional loan - or 20% home equity on a refinance - you can avoid paying monthly private mortgage insurance premiums (PMI). Also, the best mortgage rates generally go to borrowers with larger down payments, among other qualifying factors Bigger down payment: Putting more money down means you’ll borrow less. Lower purchase price: The less you borrow, the lower your mortgage payment. If your mortgage calculator results are not yielding the lower monthly payments you hoped for, here are several techniques to try:

(T) Taxes: Property taxes required by your city and county government. If the same $320,000 loan above has a 4% rate, then you’ll pay $12,800 for the first year in interest repayment (I) Interest: The amount of interest you’ll pay to borrow the principal. If you buy a home for $400,000 with 20% down, then your principal loan balance is $320,000 (P) Principal: The amount you owe without any interest added. Your mortgage payment consists of four costs, which loan officers refer to as ‘PITI.’ These four parts are principal, interest, taxes, and insurance. Here are tips to get your best mortgage rate Shop for a lower rate: Rate shopping doesn’t have to take long, and it’s well worth the savings. However, you will pay more in total interest over the life of the loan Longer loan term: A longer loan term means lower monthly payments. Avoid private mortgage insurance: When you put at least 20% down on a conventional loan - or 20% home equity on a refinance - you can avoid paying monthly private mortgage insurance premiums (PMI). Also, the best mortgage rates generally go to borrowers with larger down payments, among other qualifying factors Bigger down payment: Putting more money down means you’ll borrow less. Lower purchase price: The less you borrow, the lower your mortgage payment. If your mortgage calculator results are not yielding the lower monthly payments you hoped for, here are several techniques to try: Mortgage calculator monthly payment to find mortgage how to#

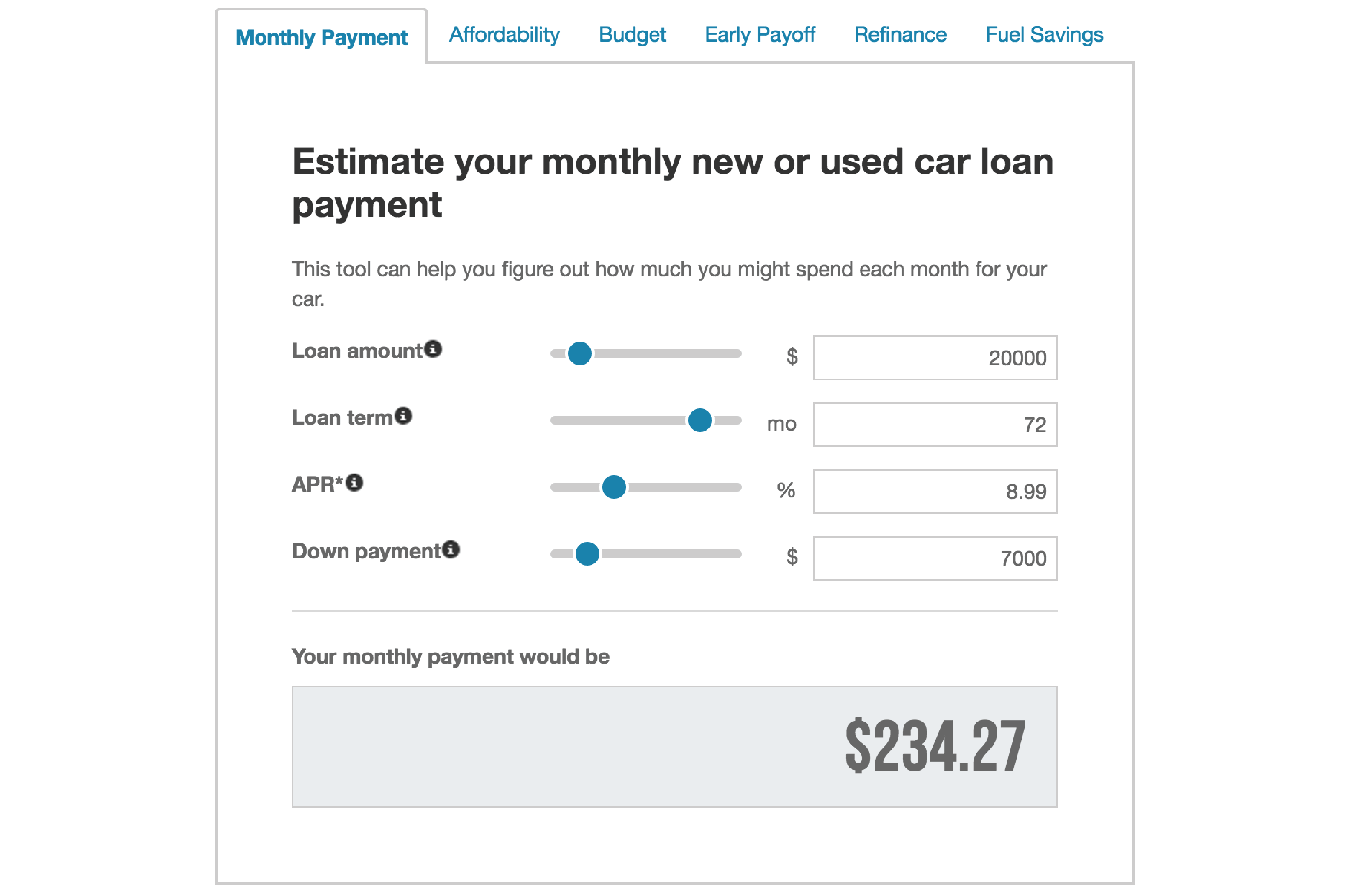

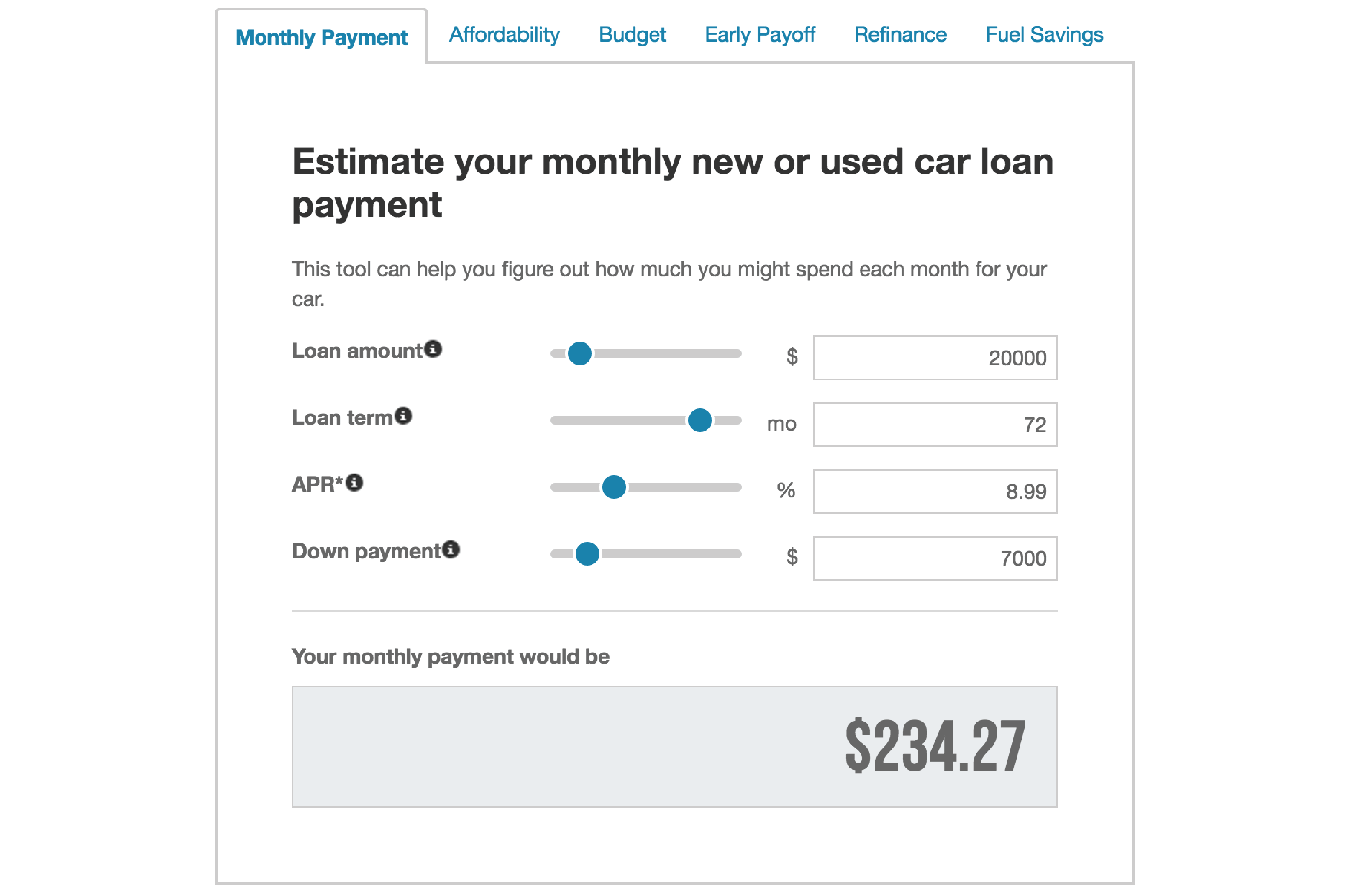

Start here How to lower your monthly payments To find out how much house you can afford based on your monthly budget.To find out how much house you can afford based on your annual household income.To find the monthly mortgage payment on a home, given current mortgage rates and a specific home purchase price.You can use the mortgage payment calculator in three ways: You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation. This mortgage payment calculator will help you find the cost of homeownership at today’s mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees. >Related: How to buy a house with $0 down: First-time home buyer How to use this mortgage calculator

0 kommentar(er)

0 kommentar(er)